Konsep Maisir dalam Pandangan Fukaha dan Relevansinya pada Asuransi Konvensional

The Concept of Maisir in the View of Fuqaha and Its Relevance to Conventional Insurance

DOI:

https://doi.org/10.36701/bustanul.v6i1.1862Keywords:

maisir, conventional insurance, Sharia insuranceAbstract

This study aims to analyze the concept of maisir in Islam according to the views of the fuqaha and then relate it to conventional insurance and sharia insurance and the relevance of the concept of maisir in the context of conventional insurance in Indonesia, which is increasingly developing along with the needs of financial protection for the community. This research uses an analytical descriptive method which aims to analyze certain objects, conditions, or phenomena in natural or real conditions (without experiments) to compile a systematic overview and provide detailed, factual, and accurate descriptions. This type of research is a type of library research by reviewing the opinions of Ulama on the concept of maisir according to Fuqaha in the Fiqh literature and then reviewing its relevance to conventional insurance practices. The results of the study indicate that conventional insurance contains elements of maisir, because in practice there are aspects of speculation of chance so that it is possible for the perpetrators to be in two unclear states between profit or loss. This is because conventional insurance uses a tijari contract instead of a tabarru' contract. Therefore, this study recommends the development of a sharia-based insurance model based on the principle of ta'awun (mutual assistance) and fair risk sharing in order to provide an alternative that is in accordance with Islamic law.

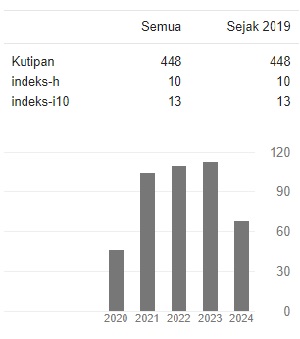

Downloads

References

Fazri, Fanisyah, dan Lili Kurniawan. “Aspek Hukum Pelaksanaan Perjanjian Asuransi.” Jurnal Ekonomi Manajemen Sistem Informasi 2, no. 6 (2021): 772–84. doi:10.31933/jemsi.v2i6.641.

Ihsanudin, Tsaqif. “Pelajaran Dari QS. Al-Maidah ayat 90: Fenomena Judi, dari Klasik sampai Modern.” JAHE: Jurnal Ayat dan Hadits Ekonomi 2, no. 2 (2024): 102–8.

Izza, Diana, dan Siti Fatimatuz Zahro. “Transaksi Terlarang Dalam Ekonomi Syariah.” Jurnal Keabadian 3, no. 2 (2021): 28.

Jairin. “Kajian Sistem Kinerja Keuangan (Operating Financial System) Pada Asuransi Syariah dan Asuransi Konvensional Ditinjau dari Perspektif Hukum Islam.” Indonesian Interdisciplinary Journal of Sharia Economics (IIJSE) 2, no. 2 (2020): 171–89.

Mayangsari, Risfiana, Uin Fatmawati, dan Sukarno Bengkulu. “Asuransi Syariah Perspektif Hukum Ekonomi Syariah.” Jurnal Kajian Hukum Ekonomi Syariah 1, no. 2 (2023): 67–78.

Mukhsinun, dan Utihatli Fursotun. “Dasar Hukum Dan Prinsip Asuransi Syariah Di Indonesia.” Jurnal Labatila 2, no. 01 (2019): 53–73. doi:10.33507/lab.v2i01.107.

Nelly, Roos. “Perkembangan Asuransi Syariah.” Juripol 4, no. 1 (2021): 437–48. doi:10.33395/juripol.v4i1.11187.

Rachman, Acep Akmal Saeful, Ai Nazwa Nurbayati, Dayandra Suspita Putri, dan Deden Najmudin. “Pertanggung Jawaban Pidana Bagi Pelaku Judi Online Ditinjau dalam Perspektif Hukum Islam dan Hukum Positi.” CAUSA: Jurnal Hukum dan Kewarganegaraan 1, no. 11 (2023): 1–16.

Ridlwan, Ahmad Ajib. “Asuransi Perspektif Hukum Islam.” Jurnal Hukum dan Ekonomi Syariah 04, no. 1 (2016): 77.

Rudiansyah. “Telaah Ghara, Riba dan Maisir dalam Perspektif Transaksi Ekonomi Islam (Study of Ghara, Riba and Maisir in the Perspective of Islamic Economic Transactions).” AL Huquq Journal of Indonesia Islamic Economic Law 2, no. 1 (2020): 98–113.

Sari, Intan Novita, dan Lysa Ledista. “Gharar Dan Maysir Dalam Transaksi Ekonomi Islam.” Izdihar: Jurnal Ekonomi Syariah 2, no. 2 (2022): 22–40. doi:10.32764/izdihar.v2i2.2610.

Sari, Ririn Linda Tunggal, Sumarlam Sumarlam, dan Dwi Purnanto. “Tindak Tutur Dalam Proses Jual Beli Di Pasar Tradisional Surakarta.” PRASASTI: Journal of Linguistics 1, no. 1 (2016): 137–50. doi:10.20961/prasasti.v1i1.912.

Syamsuri, Nirhamna Hanif Fadillah, Amir Reza Kusuma, dan Jamal. “Analisis Qanun (Lembaga Keuangan syariah) Dalam Penerapan Ekonomi Islam Melalui Perbankan Syariah di Aceh.” Jurnal Ilmiah Ekonomi Islam 7, no. 03 (2021): 1705–16. http://jurnal.stie-aas.ac.id/index.php/jie.

Zulfaa, Nabila. “Bentuk Maisir Dalam Transaksi Keuangan.” Jurnal Hukum Ekonomi Islam (JHEI) 2, no. 1 (2018): 1–15.