Hukum Menyegerakan Penyerahan Zakat Harta dan Zakat Fitrah di Saat Pandemi Covid-19

DOI:

https://doi.org/10.36701/bustanul.v1i2.140Keywords:

Zakah, Money, Fitrah, Ta'jil, Covid-19.Abstract

The objective of this research was to recognize the law of hastening the payment of zakat on wealth and zakat al-fitr in the midst of Covid-19 pandemic. This research used a descriptive qualitative approach which was an attempt to understand various concepts found in the research process by using content analysis techniques and library research. The results of the study show that: first, it is possible to immediately pay zakat on wealth on condition that the ratio must be sufficient, according to a strong opinion namely that is the opinion of the majority of scholars; second, as for zakat al-fitr, the opinion which is a view in the Shafi'i school can be a solution for the current situation that it is permissible to hasten zakat al-fitr since the beginning of Ramadan. But the stronger opinion is that zakat al-fitr can only be paid one day or two days prior to the id according to a clear argument and guidance. As for the urgency of the needs of the Muslims, this does not necessarily become a reason that allows the hastening of zakat al-fitr so that it becomes the only solution that must be taken. However there is another solution, it is enhancing the encouragement for those who have adequate amount to optimize charity and alms aimed at our brothers and sisters who are in need in the midst of Covid-19.

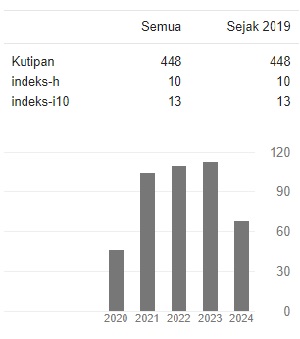

Downloads

References

Al-Bukhari, Muhammad bin Ismail. (1400H). al-Jami' al-Shahih, Juz. 1. Kairo: al-Mat'ba'ah al-Salafiyah.

Al-Daraquthni, Ali bin Umar. (2004). Sunan al-Daraquthni, Juz 3. Beirut: Muassasah al-Risalah.

Al-Fauzan, Shalih. (2009). Al-Mulakhkhas al-Fiqhi, Juz 1. Iskandariah: Dar al-Aqidah.

Al-Ifta al-Urdun, Yajuzu Ta'jil Zakah bi Syurut, Situs Resmi Ifta Yordania, http://aliftaa.jo/Question.aspx?QuestionId=2974.

Al-Kasani. (1986). Badāi’ al-Sanāi’ fi Tartib al-Syarāi’, Juz 2. Beirut: Dar Kutub Ilmiyah.

Asy-Syirazi. (1992). Al-Muhadzdab fi Fiqh Imam Syafi'i, Juz 1. Damaskus: Dar al-Qalam.

Bin Baz. Hukmu Ta'jil Zakah wa Miqdaruha fil Mal wa Hukmu Ikhrajiha min gairil mal allazi wajabat fihi zakah. Situs Resmi Syekh Bin Baz. https://binbaz.org.sa/fatwas/11229.

Hazm, Ibnu. (1349 H). Al-Muhalla, Juz 6. Mesir: Idarah Al-Tiba'ah Al-Muniriyyah.

Iskandar, A., Aqbar, K. (2019). Kedudukan Ilmu Ekonomi Islam di Antara Ilmu Ekonomi dan Fikih Muamalah: Analisis Problematika Epistemologis. NUKHBATUL ‘ULUM: Jurnal Bidang Kajian Islam, Vol. 5, No. 2, h. 88-105.

Islam Web.net. Hukmu Ikhraj Ba'dhi Zakah Qabla Hulul Haul. Situs Resmi Islam Web. https://www.islamweb.net/ar/fatwa/113457.

Qudamah, Ibnu. (1997). Al-Mugni, Juz 4. Riyadh: Dar Alam Kutub.

Rusyd, Ibnu. (1995). Bidayah al-Mujtahid wa Nihayah al-Muqtasid, Juz 2. Beirut: Dar Ibnu Hazm.